ny paid family leave tax code

- Ran trail payroll and have correct EMPLOYEE deduction. What category description should I choose for this box 14 entry.

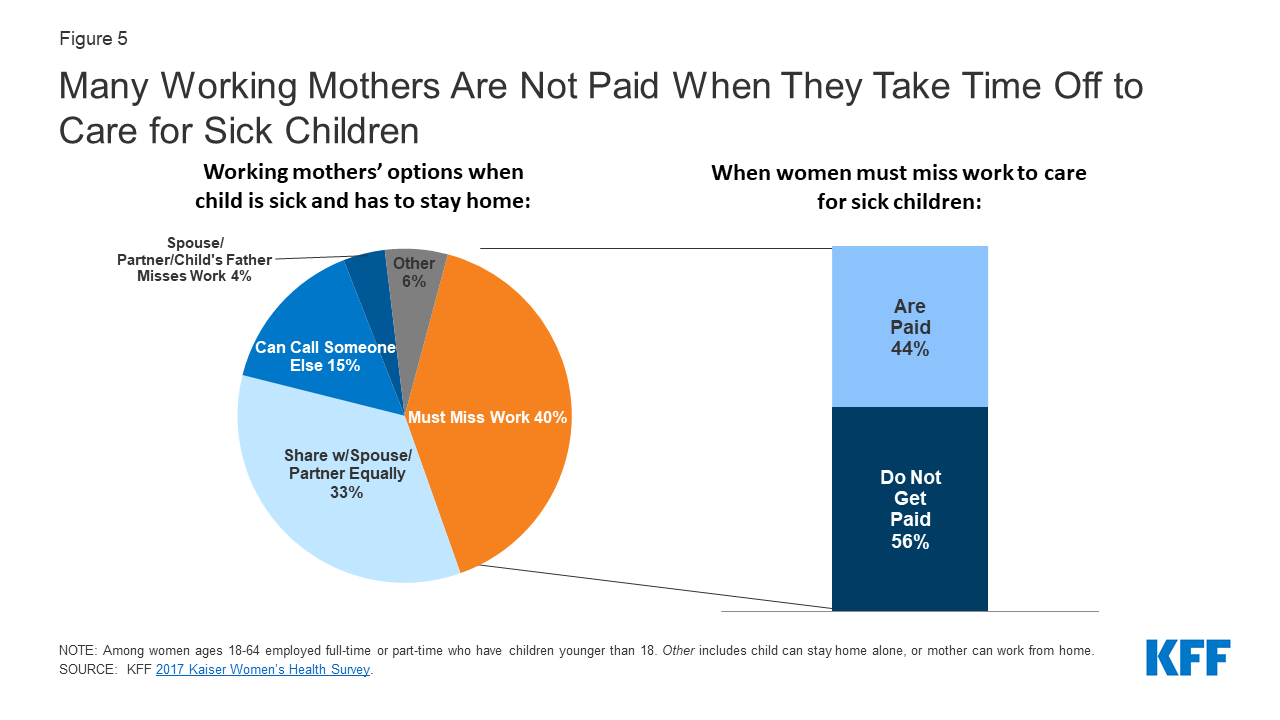

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

On August 25 2017 the New York State Department of Taxation and Finance DFS released highly anticipated guidance regarding taxation of PFL benefits and premium in Notice N-17-12.

. NY Paid Family Leave Taxation Guidance Released. Commissions and bonuses are considered wages for PFL purposes. Benefits paid to employees will be taxable non-wage income that must be included.

For the last couple of years NYS have being deducting premiums for the Paid Family Leave program. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. NY Paid family leave.

A minor child of the employer. Or maybe you have questions about the information you need to provide on form PFL-1 part B. In 2016 New York enacted the nations strongest and most comprehensive Paid Family Leave policy.

The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a state disability insurance tax. 1 Obtain Paid Family Leave coverage. Domestic or personal employees who work 40 or more hours per week for one employer.

An employer may choose to pay for the Paid Family Leave benefit on behalf of employees. Big changes arrived for New Yorkers on January 1 2018 when the New York Paid Family Leave NYPFL benefit went into effect. - Definedset up Tax Code.

NY Paid family leave. Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. Coverage is not required for the following employees however private employers may voluntarily opt them in for both disability benefits and Paid Family Leave by providing coverage and notifying the Board.

This deduction shows in Box 14 of the W2. NYPFL benefits are paid to employees as taxable non-wage income. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

Is Nypfl subject to NY tax. Today working families no longer have to choose between caring for their loved ones and risking their economic security. Bond with a newly born adopted or fostered.

If the Suppress option 154-07 Suppress NY Paid Family Leave is selected at the PSID-level on the Payroll Service ID page under Payroll Options State Taxability section the NY FLI tax is suppressed for all employees in the PSID regardless of the employee-level settings. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. 67 of the employees average weekly wage or 67 of the statewide average weekly wage whichever is less.

If an employer chooses to hire a temporary employee to replace a regular employee while they are on Paid Family Leave could. Employers may offer employees the option of using any accrued unused paid vacation or personal. The description have not being added on the drop down menu of the W2 worksheet forcing to list it as Other.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. If so you may be feeling a bit flustered by the forms involved. 2 Collect employee contributions to pay for their coverage.

Share by Twitter. What category description should I choose for this box 14 entry. There should be a drop down code for NY PFL as a deductible mandatory state tax.

What category description should I choose for this box 14 entry. With the NY Paid Family Leave program in full swing do you have employees requesting to take leave. On December 29 2021 the Office of the State Comptroller issued State Agencies Bulletin No 1982 to inform agencies of the 2022 New York State Paid Family Leave Program rate.

The maximum annual contribution is 42371. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. New York designed Paid Family Leave to be easy for employers to implement with three key tasks.

Email to a Friend. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. Contact your Paycor representative if you have any questions with configuration.

Your state taxes paid including NYPFL in Box 14 are deductible if you itemize your deductions on Schedule A of your federal tax return. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

Paid Family Leave provides eligible employees job-protected paid time off to. It is important to understand that the information does not get prepared and sent to the Payroll. SETTING UP A NEW YORK PAID FAMILY LEAVE DEDUCTION.

Paycor has a deduction code NYPFL that is used for the payroll deduction and the default rate of 511 is displayed in the application. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836.

Requirements for other types of employers are. On the 2020 edition there is no Other option please see the screenshot above. By Christopher Caldari and Dan Kuperstein JD.

W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program has tax implications for New York employees employers and insurance carriers including self-insured employers employer. 3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave.

- Used Tax Rule type WCEE with necessary parameters in System Tax Tables. - Add to individual tax detail. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. ProSeries Tax Idea Exchange. Max 165 per week -or- 0126 up to 130592.

Read the full bulletin. This is 9675 more than the maximum weekly benefit for 2021. Employee-paid premiums should be deducted post-tax not pre-tax.

Vacation and Personal Leave. They are however reportable as income for IRS and NYS tax purposes. Called one of the most comprehensive paid family leave programs in the nation the law requires employers to allow employees to take paid job-protected leave to tend to a family.

Here are the key points. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. The description for this entry is PAID FAMILY LEAVE.

Just created a new tax id NYPF for NEW YORK PAID FAMILY LEAVE.

New National Paid Leave Proposals Explained

Explainer Paid Leave Benefits And Funding In The United States

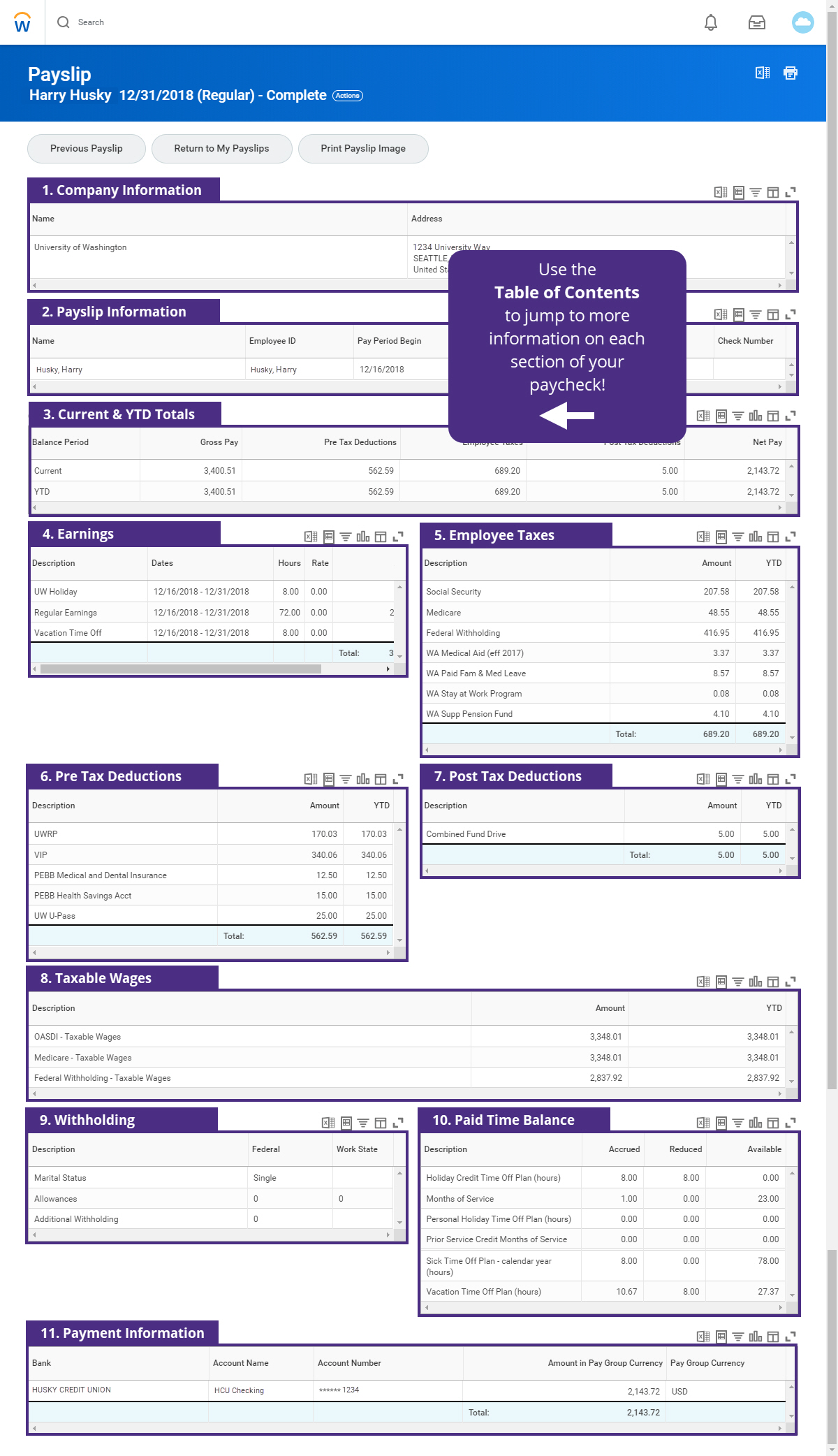

How To Read Your Payslip Integrated Service Center

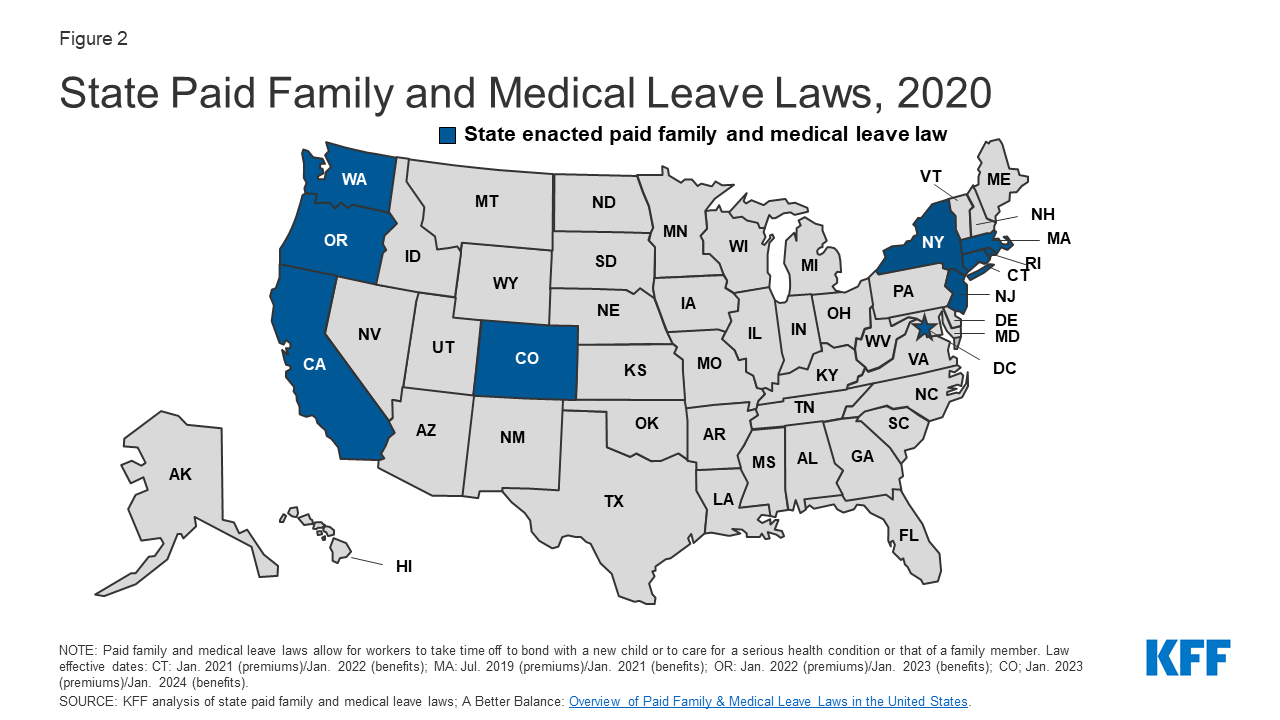

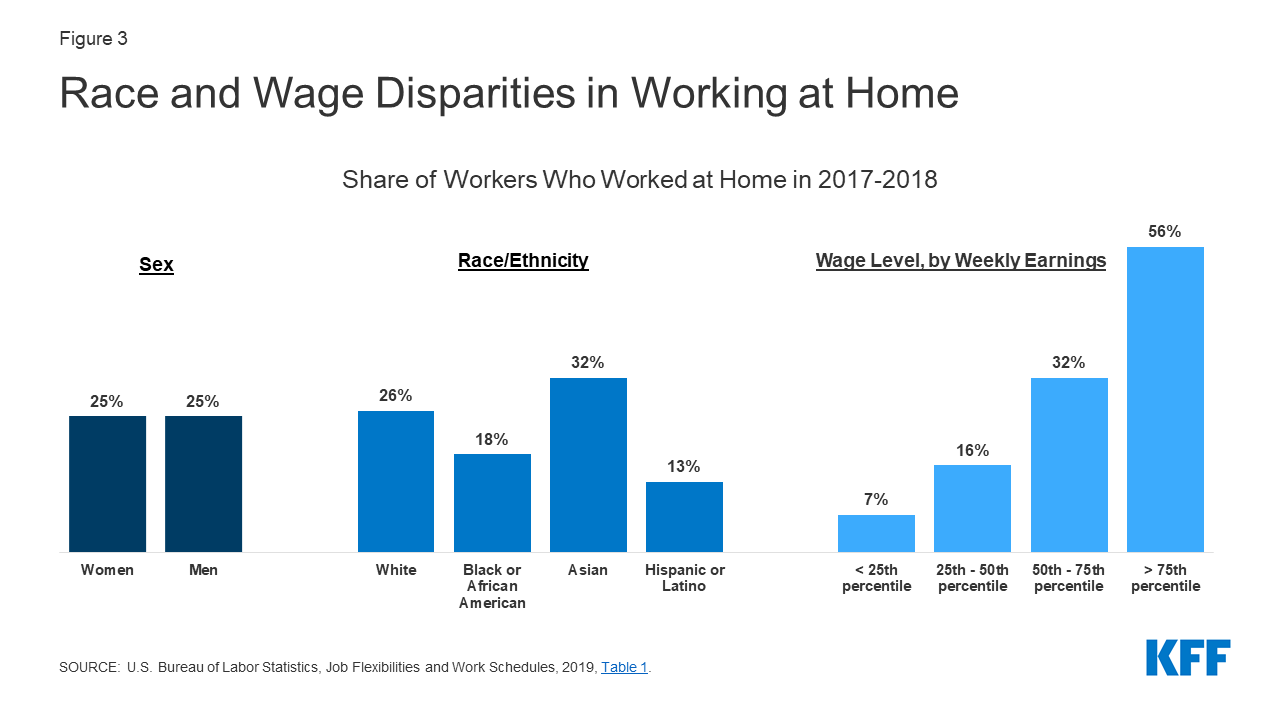

Time Off To Care State Actions On Paid Family Leave

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

New York State Paid Family Leave Cornell University Division Of Human Resources

2021 State Paid Family And Medical Leave Contributions And Benefits Mercer

Paid Parental Leave Around The World And How The U S Compares The Washington Post

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QLLD7S6BRVPEXIABPLCQJVKWJA.jpg)

Morgan Stanley Increases Parental Leave In Employee Benefits Overhaul Memo Reuters

Know Your Rights Get The Facts About Paid Leave Time S Up Foundation

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Time Off To Care State Actions On Paid Family Leave

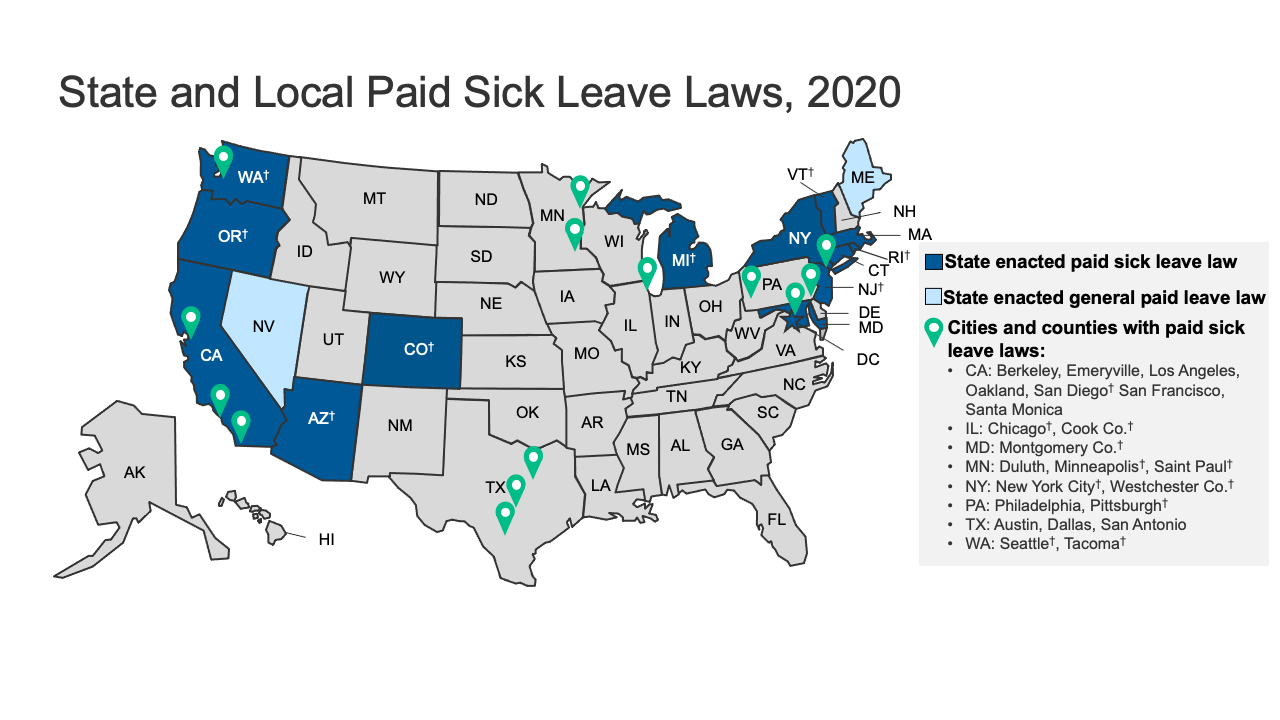

Paid Sick Leave Laws By State Chart Map And More

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Rhetoric Vs Reality Not All Paid Leave Proposals Are Equal Center For American Progress